The Department of Finance's failure to honor the Notice of Claim filed by Manila Water on April 23, 2015 has spurred the private water concessionaire to file a Notice of Arbitration with the Permanent Court of Arbitration in Singapore.

Through this Notice of Claim to the Republic of the Philippines via the Department of Finance, Manila Water called upon the government’s Letter of Undertaking to reimburse its losses in operating revenues arising, it said, from a significant diminution in the rate of return committed in its concession contract.

These losses are expected to be reimbursed as they are actualized for each remaining year of Manila Water’s Concession, and which are at this point estimated to amount to P79 billion for the entire period of 2015 up to 2037.

In the Letter of Undertaking, the Republic, through the DOF, undertook to indemnify Manila Water, against any loss caused by any action on the part of the MWSS resulting in the reduction of the standard rates “below the level that would otherwise be applicable in accordance with the Concession Agreement.” This effectively denied Manila Water a rate of return “allowed from time to time to operators of long term infrastructure concession agreements in other countries having a credit standing similar to the Philippines” pursuant to Section 9.4 of the Concession Agreement.

Even if Manila Water continues to pursue its claim, it has started to implement the new rates set by MWSS in June 2015 which incorporates a reduction of P1.66 per cubic meter in the basic charge.

- Interaksyon

Philippines News: FREE

Monday, December 14, 2015

Wednesday, November 4, 2015

Rental revenue lifts SM Prime's profit by 70%

SM Prime Holdings, Inc. (SM Prime), the Philippines’ leading integrated property company, booked a whopping 70-percent surge in profit in the first nine months of 2015 on the back of the growth in rental revenues.

Its consolidated net income reached P22.9 billion in January to September from P13.47 billion during the same period last year.

This was inclusive of the P7.4-billion one-time trading gains on marketable securities booked in the first quarter of the year.

On a recurring basis, net income surged by 15 percent to P15.5 billion in the first nine months.

Consolidated revenues rose nine percent to P52.2 billion after third-quarter earnings reached P16.2 billion.

“SM Prime’s expansion across all its various business portfolios since 2013 has driven its strong financial performance this year. We expect SM Prime’s growth to be sustained as we continue to increase our mall footprint by 13 percent this year. We are excited to launch SM Seaside Cebu later this year, a landmark project in the Visayas region. We see Metro Cebu as one of our important growth corridors following our growth track in Metro Manila,” SM Prime President Hans T. Sy said.

Rental revenues from retail and commercial spaces, which contributed 56 percent to the consolidated revenues, increased by 11 percent to P29.4 billion from P26.4 billion.

The growth in rental revenues was mainly driven by rising contribution from the new malls and the expansion of shopping spaces in existing malls in 2013 and 2014.

SM Prime’s real estate sales, which account for 32 percent of the consolidated revenues, grew by 4 percent to P16.6 billion, mainly due to higher sales take-up and construction accomplishment of SMDC projects.

It maintained a total of 52 malls in the Philippines and six malls in China in the first nine months with total retail space of 7.6 million square meters.

SM Prime is set to open its regional landmark, SM Seaside City Cebu, later this month. It is also expanding two existing malls --SM City Lipa in Batangas and SM City Iloilo.

By the end of 2015, SM Prime will have 55 malls in the Philippines and six malls in China with an estimated combined GFA of 8.3 million sqm.

It currently has 27 residential projects in the market, 25 of which are in Metro Manila and two in Tagaytay.

Meanwhile, the Commercial Properties Group has five office buildings with an estimated gross floor area of 318,000 square meters. Five E-com Center will be formally launched this month.

- Interaksyon

Friday, October 23, 2015

Credit Suisse upbeat on Asia Pacific wealth outlook, sees profitability doubled by 2018

Credit Suisse announced Thursday it was investing more capital and resources into the Asia Pacific region, where it noted growing wealth and deepening financial markets. It also announced the appointment of the first Southeast Asian to the bank’s Executive Board: Helman Sitohang, currently Chief Executive Officer, Asia Pacific.

The announcement came following a global strategic review of Credit Suisse Group.

Credit Suisse, meanwhile, reported record results for Asia Pacific, with January-September 2015 revenues rising to 3 billion Swiss francs (up 17%) and pre-tax income is CH 1.1 billion, up 48%.

The results were driven by continued strong performances across the bank in Asia Pacific and its highly successful ‘One Bank’ model, under which it provides integrated Private Banking & Wealth Management and Investment Banking products to its clients.

Mr. Sitohang said: “Credit Suisse Asia Pacific generated record pre-tax income for the first nine months of the year. Asia Pacific now accounts for 15% of total Credit Suisse revenues and 28% of pre-tax income. This is a strong performance, particularly given the current market conditions and demonstrates the resilience of our business model and our ability to generate profitability through the cycle.”

Credit Suisse Asia Pacific has now set a target to double pre-tax income and client assets under management in the region by the end of 2018. Currently Credit Suisse has CHF133 billion of client assets under management and in the first nine months gathered CHF14.7 billion of net new assets, representing 55% of the bank’s total Private Banking net new assets.

Mr. Sitohang said: “We are making a significant investment of capital and resources into Asia Pacific. Our focus is on being a partner to our High Net Worth Individual, Entrepreneur and Institutional clients and supporting them in their growth ambitions. We plan to expand further in our core markets, capitalizing on our strengths in Southeast Asia and building out our China franchise, while maintaining a consistent culture of compliance and controls.

“Our ambition is to be the Trusted Entrepreneurs Bank in Asia Pacific, and a key destination for talent.”

First-generation entrepreneurs

According to the Credit Suisse Research Institute Family Business Model 2015 report, 57% of new wealth in Asia Pacific is driven by first generation entrepreneurs and family ownership of listed companies is expected to grow in many markets in the region as more wealth is created.

“As wealth in Asia Pacific grows and financial markets deepen, we see significant opportunities to help our clients capture this growth. Our track record of performance, our culture of partnership and our strong client franchise gives Credit Suisse in Asia Pacific a strong platform. With the additional investment in the region, we expect to further build on this platform to the benefit of our key Entrepreneur and Investor clients,” Mr. Sitohang said.

- Interaksyon

The announcement came following a global strategic review of Credit Suisse Group.

Credit Suisse, meanwhile, reported record results for Asia Pacific, with January-September 2015 revenues rising to 3 billion Swiss francs (up 17%) and pre-tax income is CH 1.1 billion, up 48%.

The results were driven by continued strong performances across the bank in Asia Pacific and its highly successful ‘One Bank’ model, under which it provides integrated Private Banking & Wealth Management and Investment Banking products to its clients.

Mr. Sitohang said: “Credit Suisse Asia Pacific generated record pre-tax income for the first nine months of the year. Asia Pacific now accounts for 15% of total Credit Suisse revenues and 28% of pre-tax income. This is a strong performance, particularly given the current market conditions and demonstrates the resilience of our business model and our ability to generate profitability through the cycle.”

Credit Suisse Asia Pacific has now set a target to double pre-tax income and client assets under management in the region by the end of 2018. Currently Credit Suisse has CHF133 billion of client assets under management and in the first nine months gathered CHF14.7 billion of net new assets, representing 55% of the bank’s total Private Banking net new assets.

Mr. Sitohang said: “We are making a significant investment of capital and resources into Asia Pacific. Our focus is on being a partner to our High Net Worth Individual, Entrepreneur and Institutional clients and supporting them in their growth ambitions. We plan to expand further in our core markets, capitalizing on our strengths in Southeast Asia and building out our China franchise, while maintaining a consistent culture of compliance and controls.

“Our ambition is to be the Trusted Entrepreneurs Bank in Asia Pacific, and a key destination for talent.”

First-generation entrepreneurs

According to the Credit Suisse Research Institute Family Business Model 2015 report, 57% of new wealth in Asia Pacific is driven by first generation entrepreneurs and family ownership of listed companies is expected to grow in many markets in the region as more wealth is created.

“As wealth in Asia Pacific grows and financial markets deepen, we see significant opportunities to help our clients capture this growth. Our track record of performance, our culture of partnership and our strong client franchise gives Credit Suisse in Asia Pacific a strong platform. With the additional investment in the region, we expect to further build on this platform to the benefit of our key Entrepreneur and Investor clients,” Mr. Sitohang said.

- Interaksyon

Monday, September 28, 2015

Puregold Price Club, Inc: Aggressive expansion continues

On track to meet estimates.

PGOLD’s margins in 1H15 seemed weak initially with Puregold brand stores registering a gross margin of only 15.0%. Accounting for the delayed booking of Php150Mil of gross profit last year, this implies a y/y decline of 50 basis points. However, management clarified that the decline was due to a change in accounting treatment which moved items down from gross profit to other income. Adjusting for this, gross margin of Puregold stores was flattish at 15.5% in 1H15, in line with our expectations.

Raising FV to Php55/sh on rollover, maintain BUY rating

We are raising our FV estimate on PGOLD to Php55/sh from Php50/sh as we rollover to end-2016 estimates. We are also maintaining our BUY rating on PGOLD as valuations on the stock remain cheap. At its current price of Php32/sh, the stock is being valued at 16.5X 2016E P/E, a discount relative to the 17.7X P/E of the market and the 20.5X P/E of other consumer stocks.

- COL Financial

PGOLD’s margins in 1H15 seemed weak initially with Puregold brand stores registering a gross margin of only 15.0%. Accounting for the delayed booking of Php150Mil of gross profit last year, this implies a y/y decline of 50 basis points. However, management clarified that the decline was due to a change in accounting treatment which moved items down from gross profit to other income. Adjusting for this, gross margin of Puregold stores was flattish at 15.5% in 1H15, in line with our expectations.

Raising FV to Php55/sh on rollover, maintain BUY rating

We are raising our FV estimate on PGOLD to Php55/sh from Php50/sh as we rollover to end-2016 estimates. We are also maintaining our BUY rating on PGOLD as valuations on the stock remain cheap. At its current price of Php32/sh, the stock is being valued at 16.5X 2016E P/E, a discount relative to the 17.7X P/E of the market and the 20.5X P/E of other consumer stocks.

- COL Financial

Wednesday, September 16, 2015

Megaworld Corporation: Improved visibility on leasing expansion

We reiterate our BUY rating on MEG. We like MEG for the continuous expansion of its rental income portfolio. Based on the company’s expansion plans, total leasing portfolio will increase at a CAGR of 16.7% from 791,000sqm as of end 2014 to 1.7 Mil sqm by end 2019. Moreover, at its current price of Php4.30, MEG is trading at a steep 47.7% discount to NAV. Furthermore, MEG is trading at only 13.56X FY15 P/E, less than half of ALI’s current FY15E P/E of 30.5X. This is despite the fact that MEG is growing its more defensive rental income portfolio which should strengthen the company’s ability to withstand economic downturns going forward. As of FY14, operating profit from MEG’s leasing business accounted for 43% of consolidated operating profit, already larger compared to 32% for ALI. See full report here.

- Col Financial

- Col Financial

Wednesday, September 9, 2015

COLing the Shots: Learning from past corrections and bear markets

COL Financial released their latest COLing the Shots report entitled "Lessons from past corrections and bear markets".

Below are the key highlights of our latest view on the market:

- After studying the characteristics of two previous bear markets and three major corrections in the Philippines, we have two major insights, namely "This is just a major corrrection, not a bear market" and "There is a good chance that we have already seen the low."

- We believe that there is a strong likelihood that we have already seen the worst. With careful consideration of current market conditions, we think that now would be a good time to start accumulating stocks. Remember to choose quality names, to space your orders over a span of six months or to practice cost-averaging, and to determine an entry price that will allow you to capitalize on downward swings in the market. This is an opportunity to buy quality stocks that normally trade at expensive valuations.

- After reviewing our stock picks, we have decided to remove FLI and add MEG and BDO to our COLing the Shots stock picks list.

- COL financial

Friday, August 28, 2015

Second quarter GDP grew 5.6%, some notable improvements compared to the first quarter

2Q15 GDP growth reached 5.6%, faster than the first quarter’s revised GDP growth of 5.0%. Given

the economy’s performance for the second quarter, GDP growth for the first half of the year reached

5.3%.

Although GDP growth for the second quarter was somewhat disappointing as it missed consensus growth expectations of 5.7%, there were some notable improvements compared to the first quarter.

- COL financial

Although GDP growth for the second quarter was somewhat disappointing as it missed consensus growth expectations of 5.7%, there were some notable improvements compared to the first quarter.

- Government spending growth accelerated to 3.9% from 1.7% in the first quarter as public construction jumped by 20.4% after falling by 24.6% during the first quarter

- Consumer spending growth remained robust, accelerating to 6.2% in the second quarter from 6.0% during the first quarter. This is most likely partly attributable to the faster growth of OFW remittances during the second quarter as reflected by the acceleration of net primary income from abroad to 5.0% during the second quarter from 0.8% during the first quarter

- Growth in investment spending or capital formation accelerated further to 17.4% from 11.6% during the first quarter as construction spending increased further by 13.1% from 6.7% q/q. The continuous growth in investment spending implies more sustainable economic growth going forward.

- Exports surprisingly remained positive, growing by 3.7% during the second quarter as the 31.3% jump in the exports of services (largely through the BPO sector) more than offset the 3.0% drop in the exports of goods. This continues to show the resilience of the Philippine economy to the weakness in the global economy.

- COL financial

Tuesday, August 25, 2015

COL Market Update: Philippine market hit by contagion

Philippine Market hit by contagion

- The PSEi is currently suffering from a major correction, triggered by the People's Bank of China's (PBoC) move earlier this month which led to the devaluation of the yuan.

- As discussed previously, the Philippines is not expected to be a major loser of the devaluation of the yuan as the country is not very dependent on exports. We also enjoy a strong current account surplus, thanks to our resilient OFW remittances and our strong BPO sector. Nevertheless, the strength of the local economy doesn't spare us from contagion risk. Note that for the month of August, the stock markets of our closest peers Thailand and Indonesia are down by 8.8% and 13.1% respectively as their economies are expected to be hurt by the yuan devaluation. This in turn negatively affected sentiment for the Philippine stock market.

- Although the Philippine market's ongoing sell-off is due to external factors, we as investors should make decisions based on what we see rather than what we think. Objectively speaking, the PSEi's technical picture has deteriorated significantly. Today, the PSEi broke its six and a half year uptrend line and two important support levels namely 7,272 and 6,950. The PSEi is also currently 17% off its April high of 8,136.

Some tips on coping with sharp market drops include the following:

1. Raise cash, don't use margin

Rallies

that take place in the short term should be viewed as opportunities to

raise cash. This should help us avoid the risk of being forced to sell

at the low or not having any cash to buy when stocks are already cheap.

While selling right now can be emotionally painful in the short term,

reducing exposure in the stock market during difficult times helps us

mentally prepare to buy bargains as markets gradually bottom.

2. Prefer peso cost averaging over lump sum investing

When

markets drop, it creates opportunities to buy bargains. This is

especially true for markets such as ours which do not deserve to be

sold-off based on fundamentals. While we think 6,500 would be a good

level to buy this market, there is no guarantee that the PSEi will

bottom at the said level. Consequently, it would be more ideal to adopt a

peso cost averaging strategy over the next six months instead of timing

the perfect entry point when buying this market.

One

of the opportunities that will be created by the ongoing market

sell-off is the opportunity to buy quality stocks that normally trade at

expensive valuations when the market is not correcting. While there is

nothing wrong with any of our existing stock picks, we might remove some

to make way for other quality names that professional fund managers

normally focus on because of size and liquidity. This is because we

expect the said blue chip stocks to go up first when the PSEi recovers.

Stay tuned as we make further announcements in the next few days or

weeks regarding the market and our stock picks given the numerous

changes happening globally.

To download the full report, please click here.

Saturday, August 15, 2015

Bloomberg TV Philippines promises to boost Filipinos' financial literacy, economic contribution

Bloomberg TV Philippines, the first 24-hour business news channel in the country that starts airing in September, aims to boost its audience’s financial literacy, as well as their participation in the economy.

This is according to executives of Bloomberg Television, MediaQuest Holdings and its subsidiary Cignal TV during the trade launch on Wednesday night at the Makati Shangri-La.

Cignal became Bloomberg Television’s fifth local partner in Asia in March, when the two signed a multiple-year contract in Manila. As opposed to the Bloomberg Television channel that Cignal already carries, Bloomberg TV Philippines will have more local content.

According to Noel Lorenzana, president and chief executive officer of MediaQuest and TV5, the partner-companies envision Bloomberg TV Philippines as a means to promote business and financial literacy among Filipinos.

“I think Bloomberg will be the centerpiece of that,” he said.

Bloomberg Asia Pacific head of editorial Jeremy Custance said they want to deliver to the public an understanding of the goings-on in business.

“Because without the participation of the public, the economy and the country as a whole cannot be a success. And this is one of the major drivers for coming here and partnering with Cignal,” he said.

PLDT chairman Manuel V. Pangilinan said business news was increasingly becoming an important component of Philippine life. The new channel would also connect the Philippines and Filipinos to what was happening outside of the country.

“Because clearly, economic trends outside the Philippines will affect our economy,” he told reporters in an interview after the event. MediaQuest is part of the PLDT Group.

Viewers can expect intelligent, credible, and in-depth analysis of business and news topics through the shows that would be piloted next month, according to Media 5 president and chief operating officer Jane Basas.

MediaQuest’s free-to-air channel, TV5, is working with Bloomberg Television to run Bloomberg TV Philippines.

Cignal chief operating officer Oscar Reyes, Jr. said Bloomberg TV Philippines would be a world-class operation given that Cignal was now the number one pay TV provider in the country, while Bloomberg Television was a leading authority in business news.

He said Cignal aims to have 2.5 million households and 12.5 million viewers by the end of the year.

Bloomberg Television in turn is “a global powerhouse” with around 310 million viewers globally, as well as 16.5 million unique viewers online, he said.

Custance said the audience can be assured of a “very, very talented operation,” which will count on Cignal’s experience in producing TV content, and Bloomberg Television’s financial and business knowledge.

Content would be in the form of fast, accurate information for the business audience; interviews with key players at the heart of business decision-making; and insights about young entrepreneurs across the Philippines.

Among Bloomberg TV Philippines’ anchors and presenters are entrepreneur Quintin Pastrana; TV correspondent Shawn Yao; finance analyst and management specialist JP Ong; corporate lawyer and commercial arbitration specialist Jean de Castro; international business reporter Regina Lay; international trade expert, economist, and law professor Tony Abad; social entrepreneur Michael Alimurung; and marketing expert Rod Nepomuceno.

The 20 million smartphone users and 30 million Internet users in the Philippines would also be tapped by Bloomberg TV Philippines’ digital platforms. Website Bloombergtv.ph will provide access to news and commentary online, while its social media presence (@bloombergtvph on Twitter) would give netizens information wherever they are.

A Bloomberg TV Philippines app is also available for download, as well as a Philippine Stock Exchange game that would teach players how the market worked and enable them to graduate to real stock portfolio management.

Content released by Bloomberg TV Philippines will be carried by the Bloomberg Television global network, informing people around the world about the dynamism of the Philippine economy, Custance said.

“I wish them the best of luck,” Pangilinan said. “I think they’re a great business channel for the country. We’re bringing to our shores a great business news organization in the form of Bloomberg.”

Cignal subscribers can tune in to Bloomberg TV Philippines on channel 8 SD and channel 127 HD.

- Interaksyon

This is according to executives of Bloomberg Television, MediaQuest Holdings and its subsidiary Cignal TV during the trade launch on Wednesday night at the Makati Shangri-La.

Cignal became Bloomberg Television’s fifth local partner in Asia in March, when the two signed a multiple-year contract in Manila. As opposed to the Bloomberg Television channel that Cignal already carries, Bloomberg TV Philippines will have more local content.

According to Noel Lorenzana, president and chief executive officer of MediaQuest and TV5, the partner-companies envision Bloomberg TV Philippines as a means to promote business and financial literacy among Filipinos.

“I think Bloomberg will be the centerpiece of that,” he said.

Bloomberg Asia Pacific head of editorial Jeremy Custance said they want to deliver to the public an understanding of the goings-on in business.

“Because without the participation of the public, the economy and the country as a whole cannot be a success. And this is one of the major drivers for coming here and partnering with Cignal,” he said.

PLDT chairman Manuel V. Pangilinan said business news was increasingly becoming an important component of Philippine life. The new channel would also connect the Philippines and Filipinos to what was happening outside of the country.

“Because clearly, economic trends outside the Philippines will affect our economy,” he told reporters in an interview after the event. MediaQuest is part of the PLDT Group.

Viewers can expect intelligent, credible, and in-depth analysis of business and news topics through the shows that would be piloted next month, according to Media 5 president and chief operating officer Jane Basas.

MediaQuest’s free-to-air channel, TV5, is working with Bloomberg Television to run Bloomberg TV Philippines.

Cignal chief operating officer Oscar Reyes, Jr. said Bloomberg TV Philippines would be a world-class operation given that Cignal was now the number one pay TV provider in the country, while Bloomberg Television was a leading authority in business news.

He said Cignal aims to have 2.5 million households and 12.5 million viewers by the end of the year.

Bloomberg Television in turn is “a global powerhouse” with around 310 million viewers globally, as well as 16.5 million unique viewers online, he said.

Custance said the audience can be assured of a “very, very talented operation,” which will count on Cignal’s experience in producing TV content, and Bloomberg Television’s financial and business knowledge.

Content would be in the form of fast, accurate information for the business audience; interviews with key players at the heart of business decision-making; and insights about young entrepreneurs across the Philippines.

Among Bloomberg TV Philippines’ anchors and presenters are entrepreneur Quintin Pastrana; TV correspondent Shawn Yao; finance analyst and management specialist JP Ong; corporate lawyer and commercial arbitration specialist Jean de Castro; international business reporter Regina Lay; international trade expert, economist, and law professor Tony Abad; social entrepreneur Michael Alimurung; and marketing expert Rod Nepomuceno.

The 20 million smartphone users and 30 million Internet users in the Philippines would also be tapped by Bloomberg TV Philippines’ digital platforms. Website Bloombergtv.ph will provide access to news and commentary online, while its social media presence (@bloombergtvph on Twitter) would give netizens information wherever they are.

A Bloomberg TV Philippines app is also available for download, as well as a Philippine Stock Exchange game that would teach players how the market worked and enable them to graduate to real stock portfolio management.

Content released by Bloomberg TV Philippines will be carried by the Bloomberg Television global network, informing people around the world about the dynamism of the Philippine economy, Custance said.

“I wish them the best of luck,” Pangilinan said. “I think they’re a great business channel for the country. We’re bringing to our shores a great business news organization in the form of Bloomberg.”

Cignal subscribers can tune in to Bloomberg TV Philippines on channel 8 SD and channel 127 HD.

- Interaksyon

Tuesday, August 4, 2015

Saturday, August 1, 2015

SBS maiden share sale oversubscribed

BDO Capital & Investment Corp. President Eduardo V. Francisco told

reporters the share sale is “several times” oversubscribed, allowing the

company to price the IPO at a maximum P2.75 per share.

The offer period for the IPO began yesterday, while the shares will be listed on the PSE’s Main Board on August 10 under the ticker symbol “SBS.”

BDO Capital was tapped as the sole issue manager, lead underwriter and bookrunner.

“As of this moment, all the institutional shares have been allocated.

The only thing available are the shares for the brokers,” Mr. Francisco told an investor briefing late Monday.

“Even if the market falls, I don’t think these investors will back out,” he said.

Ten percent of the shares for sale are allocated for small investors, who trooped to the Philippine Stock Exchange building in Ortigas on Tuesday only to find IPO forms have run out, Mr. Francisco said.

“Yes, demand continues to be strong,” he said in a mobile phone message yesterday.

The second company to go public this year, SBS is selling up to 420 million primary common shares, comprising 35% of the company’s issued and outstanding shares.

The absence of other IPOs this year had whet demand for the tiny IPO, Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a phone interview.

“It’s a leading chemical distributor and the products they offer are pretty diversified. Earnings growth since 2012 has been consistent,” Mr. Azurin said.

SBS grew earnings by 66% to P100.17 million last year from P60.33 million in 2013, as revenues rose 18.7% to P933.08 million from P785.95 million.

The Sytengco family owns 93.2% of SBS. The IPO will leave the family with 60.6% of the company.

SBS Chairman and President Necisto U. Sytengco said the company is going public to lay the groundwork for succession.

“It’s always better to put it in proper place so there won’t be any problem in the succession. Probably, you can even hire your own children to come in or you can hire professional people to put them in place,” Mr. Sytengco said.

Incorporated on July 17, 2001 and formerly known as Sytengco Philippines Corp., SBS supplies over 3,000 chemical products to more than 1,800 customers in various industries: food ingredients, industrial, feeds and veterinary care, pharmaceutical, personal care and cosmetics.

- Business World Online

The offer period for the IPO began yesterday, while the shares will be listed on the PSE’s Main Board on August 10 under the ticker symbol “SBS.”

BDO Capital was tapped as the sole issue manager, lead underwriter and bookrunner.

“As of this moment, all the institutional shares have been allocated.

The only thing available are the shares for the brokers,” Mr. Francisco told an investor briefing late Monday.

“Even if the market falls, I don’t think these investors will back out,” he said.

Ten percent of the shares for sale are allocated for small investors, who trooped to the Philippine Stock Exchange building in Ortigas on Tuesday only to find IPO forms have run out, Mr. Francisco said.

“Yes, demand continues to be strong,” he said in a mobile phone message yesterday.

The second company to go public this year, SBS is selling up to 420 million primary common shares, comprising 35% of the company’s issued and outstanding shares.

The absence of other IPOs this year had whet demand for the tiny IPO, Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a phone interview.

“It’s a leading chemical distributor and the products they offer are pretty diversified. Earnings growth since 2012 has been consistent,” Mr. Azurin said.

SBS grew earnings by 66% to P100.17 million last year from P60.33 million in 2013, as revenues rose 18.7% to P933.08 million from P785.95 million.

The Sytengco family owns 93.2% of SBS. The IPO will leave the family with 60.6% of the company.

SBS Chairman and President Necisto U. Sytengco said the company is going public to lay the groundwork for succession.

“It’s always better to put it in proper place so there won’t be any problem in the succession. Probably, you can even hire your own children to come in or you can hire professional people to put them in place,” Mr. Sytengco said.

Incorporated on July 17, 2001 and formerly known as Sytengco Philippines Corp., SBS supplies over 3,000 chemical products to more than 1,800 customers in various industries: food ingredients, industrial, feeds and veterinary care, pharmaceutical, personal care and cosmetics.

- Business World Online

Wednesday, July 15, 2015

Megawide, San Miguel prequalify for Regional Prison PPP project

San Miguel and Megawide will compete for the contract to build a huge prison outside the Philippine capital under the Aquino administration’s public-private partnership (PPP) scheme.

In a statement, the PPP Center said San Miguel Holdings Corporation (SMHC) and Mega Structure Consortium had passed muster with the Department of Justice (DOJ) and the Bureau of Corrections (BuCor).

A third potential bidder, DMCI Holdings Inc, failed to hurdle the prequalification stage.

The P50.2-billion Regional Prison Facilities Project involves the design, financing and construction of the modern prison facilities that will rise at Fort Magsaysay in Nueva Ecija. The winning bidder also will maintain the facility for 23 years, including the three-year construction period.

The new facility should accommodate 26,880 inmates, and apart from the detention area, should include staff housing, administrative buildings, areas for sports, work and religious activity.

The winning bidder will also install high-security equipment.

- Interaksyon

In a statement, the PPP Center said San Miguel Holdings Corporation (SMHC) and Mega Structure Consortium had passed muster with the Department of Justice (DOJ) and the Bureau of Corrections (BuCor).

A third potential bidder, DMCI Holdings Inc, failed to hurdle the prequalification stage.

The P50.2-billion Regional Prison Facilities Project involves the design, financing and construction of the modern prison facilities that will rise at Fort Magsaysay in Nueva Ecija. The winning bidder also will maintain the facility for 23 years, including the three-year construction period.

The new facility should accommodate 26,880 inmates, and apart from the detention area, should include staff housing, administrative buildings, areas for sports, work and religious activity.

The winning bidder will also install high-security equipment.

- Interaksyon

Thursday, July 2, 2015

Filinvest Land wins bid for 19-hectare Cebu property

Property developer Filinvest Land, Inc. (FLI) and its subsidiaries and affiliates won the bid for the 19.24-hectare lot located at South Road Properties (SRP) owned by Cebu City government.

In a disclosure to the Philippine Stock Exchange, FLI said they aim to develop Lot No. 1 (consolidated portions of lots 7 and 17) into commercial and/or office and residential projects, in accordance with the required minimum development plans of the city government.

Under the bidding guidelines, 70 percent of the buildable area is intended for commercial and/or office use, and the remaining 30 percent for residential use.

“The new development will complement the ongoing City di Mare project of FLI in SRP,” it said.

The property will be developed and owned by FLI, the residential property arm of the Filinvest Group, together with its office development subsidiary, Cyberzone Properties, Inc., its Central Business District affiliate, Filinvest Alabang, Inc. (FAI) and other possible strategic partners.

Earlier, a consortium formed by property giants SM Prime Holdings Inc. and Ayala Land Inc. and its affiliate Cebu Holdings, Inc, also won the bid for the development of a 26-hectare portion of SRP for P10 billion.

- Interaksyon

In a disclosure to the Philippine Stock Exchange, FLI said they aim to develop Lot No. 1 (consolidated portions of lots 7 and 17) into commercial and/or office and residential projects, in accordance with the required minimum development plans of the city government.

Under the bidding guidelines, 70 percent of the buildable area is intended for commercial and/or office use, and the remaining 30 percent for residential use.

“The new development will complement the ongoing City di Mare project of FLI in SRP,” it said.

The property will be developed and owned by FLI, the residential property arm of the Filinvest Group, together with its office development subsidiary, Cyberzone Properties, Inc., its Central Business District affiliate, Filinvest Alabang, Inc. (FAI) and other possible strategic partners.

Earlier, a consortium formed by property giants SM Prime Holdings Inc. and Ayala Land Inc. and its affiliate Cebu Holdings, Inc, also won the bid for the development of a 26-hectare portion of SRP for P10 billion.

- Interaksyon

Friday, June 12, 2015

World Bank keeps Philippine economic growth forecast despite first-quarter disappointment

The World Bank is keeping its forecast despite the Philippine economy's lower-than-expected first-quarter turnout, with the lender's lead economist saying the country's growth story has improved.

The Washington-based lender overnight launched its Global Economic Prospects (GEP) report, which show that its growth forecast for the Philippines remaining at 6.5 percent for this year. The Bank forecast the same rate for next year and 6.3 percent in 2017.

On the sidelines of the Asia-Pacific Economic Cooperation (APEC) Senior Finance Officials’ Meeting in this town, World Bank economist Rogier van den Brink said the GEP forecast already incorporates the Philippines’ first-quarter growth of 5.2 percent, which came in below market consensus of at least 6 percent.

"We see the rest of the quarters of the year showing a different pattern. We know the agencies are working very hard to ramp up spending," Van den Brink said, adding that the Philippines would benefit from a recovery in Japan and from cheap oil.

"But these relatively small changes in the growth numbers per se are secondary to the bigger story that matters. The country has established a clear trajectory towards growth that is more inclusive. Continuing reforms will ensure that the country will maintain this momentum," he said.

Van den Brink said the Philippine economic story has changed from what it was as late as two decades ago when the recurring theme was a boom-and-bust cycle marked by slow growth, high inflation, current account deficits, budget deficits and soaring government debt.

"In the last several years, these issues are no longer a major concern. We are starting to see that the sustained high economic growth in recent years is translating into stronger job creation," he said.

"Most of you will probably report on these growth forecasts for the Philippines in the context of more challenging environment, including the higher borrowing costs, lower prices for oil and other commodities, the easing of growth in China and other countries in the East Asia and the Pacific region, and so on. That's fine. But if you do focus solely on these growth forecasts, you will miss on what I think is the more important and emerging story about the Philippines," van den Brink said.

"For me, as an economist working for an institution committed to the eradication of extreme poverty, the real story is this: the Philippines has achieved macroeconomic stability, high growth rates, and, more recently, is starting to show the kind of growth which is more inclusive," he said.

- Interaksyon

The Washington-based lender overnight launched its Global Economic Prospects (GEP) report, which show that its growth forecast for the Philippines remaining at 6.5 percent for this year. The Bank forecast the same rate for next year and 6.3 percent in 2017.

On the sidelines of the Asia-Pacific Economic Cooperation (APEC) Senior Finance Officials’ Meeting in this town, World Bank economist Rogier van den Brink said the GEP forecast already incorporates the Philippines’ first-quarter growth of 5.2 percent, which came in below market consensus of at least 6 percent.

"We see the rest of the quarters of the year showing a different pattern. We know the agencies are working very hard to ramp up spending," Van den Brink said, adding that the Philippines would benefit from a recovery in Japan and from cheap oil.

"But these relatively small changes in the growth numbers per se are secondary to the bigger story that matters. The country has established a clear trajectory towards growth that is more inclusive. Continuing reforms will ensure that the country will maintain this momentum," he said.

Van den Brink said the Philippine economic story has changed from what it was as late as two decades ago when the recurring theme was a boom-and-bust cycle marked by slow growth, high inflation, current account deficits, budget deficits and soaring government debt.

"In the last several years, these issues are no longer a major concern. We are starting to see that the sustained high economic growth in recent years is translating into stronger job creation," he said.

"Most of you will probably report on these growth forecasts for the Philippines in the context of more challenging environment, including the higher borrowing costs, lower prices for oil and other commodities, the easing of growth in China and other countries in the East Asia and the Pacific region, and so on. That's fine. But if you do focus solely on these growth forecasts, you will miss on what I think is the more important and emerging story about the Philippines," van den Brink said.

"For me, as an economist working for an institution committed to the eradication of extreme poverty, the real story is this: the Philippines has achieved macroeconomic stability, high growth rates, and, more recently, is starting to show the kind of growth which is more inclusive," he said.

- Interaksyon

Friday, June 5, 2015

Philippine banks' problem loans stay manageable

The latest data from the Bangko Sentral ng Pilipinas (BSP) show that banks' problem loans remain manageable.

In a statement, the BSP said the non-performing loan (NPL) ratio of the country's biggest lenders stood at 1.95 percent at end-March, unchanged from the 1.96 percent at end-February. This ratio has been below 2 percent since November last year.

The manageable bad loan ratio was on account of NPLs rising in step with overall loan growth. Universal and commercial banks had P4.99 trillion worth of loans outstanding at end-March, while their combined NPLs stood at P97.36 billion.

The country's biggest banks also set aside more than ample reserves to cushion against these soured loans at 138.19 percent in March, down from 140.6 percent the month before.

As for thrift banks, their NPL ratio stood at 4.38 percent in the fourth quarter of last year, down from the 4.52 percent in the third quarter of the same year. Thrifts have set aside 77 percent loan loss reserves.

- Interaksyon

In a statement, the BSP said the non-performing loan (NPL) ratio of the country's biggest lenders stood at 1.95 percent at end-March, unchanged from the 1.96 percent at end-February. This ratio has been below 2 percent since November last year.

The manageable bad loan ratio was on account of NPLs rising in step with overall loan growth. Universal and commercial banks had P4.99 trillion worth of loans outstanding at end-March, while their combined NPLs stood at P97.36 billion.

The country's biggest banks also set aside more than ample reserves to cushion against these soured loans at 138.19 percent in March, down from 140.6 percent the month before.

As for thrift banks, their NPL ratio stood at 4.38 percent in the fourth quarter of last year, down from the 4.52 percent in the third quarter of the same year. Thrifts have set aside 77 percent loan loss reserves.

- Interaksyon

Friday, May 22, 2015

AirAsia PH reveals plan for IPO ‘within 2 years’

The Philippine unit of Malaysian budget carrier AirAsia Berhad is seeking a valuation of at least $500 million for its initial public offering (IPO) set within the next two years, one of its top executives said.

Michael Romero, vice chair of Philippines-based AirAsia Inc., said in a recent interview that plans to go public were still on track. This follows recent statements by Malaysian tycoon Tony Fernandes, founder of AirAsia Berhad, relating to a plan to hold an IPO for its Philippine and Indonesian units.

“We are looking at a [float] of 30 percent to 40 percent,” Romero said, meaning the carrier can raise as much as $200 million from its IPO. He declined to elaborate, as plans have yet to be finalized.

The decision comes as domestic financial operations, which include AirAsia Philippines and AirAsia Zest, are improving, consultancy firm Capa-Center of Aviation said in a report this month.

“The AirAsia Group’s Philippine affiliates likely remained in the red in [first quarter 2015] but are expected to be profitable in the second quarter of 2015,” Capa said. “This would mark the first profitable quarter for AirAsia in the Philippines.”

Capa noted that the second quarter is typically the strongest period for local carriers as this is marked by the travel-heavy summer holidays.

AirAsia, which had 15 Airbus A320s in the Philippines at the end of 2014, controls about 10 percent of the Philippine market. It mainly competes Philippine Airlines and budget airline Cebu Pacific in the domestic market.

AirAsia Philippines still receives financial support from its parent company. AirAsia Bhd said in a filing to the Malaysian Stock Exchange last Feb. 26, 2015 that it provided another $22.34 million loan to AirAsia Inc., as the Philippine unit is formally known, “to facilitate the ordinary course of business of AirAsia Inc.”

In an interview last November, Fernandes said AirAsia Bhd was committing at least $500 million for the expansion of its Philippine operations once its units were consolidated. He was referring to the consolidation of both AirAsia Philippines and AirAsia Zest, which is still ongoing.

- Inquirer

Michael Romero, vice chair of Philippines-based AirAsia Inc., said in a recent interview that plans to go public were still on track. This follows recent statements by Malaysian tycoon Tony Fernandes, founder of AirAsia Berhad, relating to a plan to hold an IPO for its Philippine and Indonesian units.

“We are looking at a [float] of 30 percent to 40 percent,” Romero said, meaning the carrier can raise as much as $200 million from its IPO. He declined to elaborate, as plans have yet to be finalized.

The decision comes as domestic financial operations, which include AirAsia Philippines and AirAsia Zest, are improving, consultancy firm Capa-Center of Aviation said in a report this month.

“The AirAsia Group’s Philippine affiliates likely remained in the red in [first quarter 2015] but are expected to be profitable in the second quarter of 2015,” Capa said. “This would mark the first profitable quarter for AirAsia in the Philippines.”

Capa noted that the second quarter is typically the strongest period for local carriers as this is marked by the travel-heavy summer holidays.

AirAsia, which had 15 Airbus A320s in the Philippines at the end of 2014, controls about 10 percent of the Philippine market. It mainly competes Philippine Airlines and budget airline Cebu Pacific in the domestic market.

AirAsia Philippines still receives financial support from its parent company. AirAsia Bhd said in a filing to the Malaysian Stock Exchange last Feb. 26, 2015 that it provided another $22.34 million loan to AirAsia Inc., as the Philippine unit is formally known, “to facilitate the ordinary course of business of AirAsia Inc.”

In an interview last November, Fernandes said AirAsia Bhd was committing at least $500 million for the expansion of its Philippine operations once its units were consolidated. He was referring to the consolidation of both AirAsia Philippines and AirAsia Zest, which is still ongoing.

- Inquirer

Saturday, May 16, 2015

Cebu Pacific's net income soars amid slump in price of jet fuel

Cebu Pacific is making a killing, as first-quarter profit soared because of the combination of lower fuel costs and strong demand for travel.

In a statement, Cebu Air Inc (CEB) said it earned P2.23 billion in the January to March period, or 1,255 percent more than the P164.16 million in the same three months last year.

"CEB attributes its bullish income and passenger growth to increased presence in key markets, strategic seat sales offering the lowest possible fares and continuous network expansion," JR Mantaring, officer-in-charge for CEB corporate affairs.

Revenue rose by a fifth to P14.2 billion this year from P11.764 billion last year.

The passenger business, which comprised nearly three-fourths of CEB’s revenue, climbed by 22 percent to P10.81 billion from P8.85 billion in 2014.

The Gokongwei-owned airline ascribed this to the 13 percent increase in passenger volume to 4.3 million from 3.8 million last year and the 8.1 percent increase in average fares to P2,525 from last year’s P2,336.

CEB mounted 14.3 percent more flights after it acquired wide-body Airbus A330 aircraft with a configuration of more than 400 all-economy class seats.

Cargo revenues increased 13.6 percent to P772.545 million from P679.818 million last year.

Operating expenses rose by a slower one percent to P11.368 billion this year from P11.252 billion last year. While the company embarked on costlier long-haul flights, cheaper jet fuel tempered overall expenses by 17 percent to P5.144 billion this year from P6.2 billion in 2014.

Aviation fuel expenses fell by 22.1 percent to P4.325 billion from P5.551 billion over the same period.

Published jet fuel prices averaged $68.98 per barrel, half the $121.47 in 2014.

- Interaksyon

In a statement, Cebu Air Inc (CEB) said it earned P2.23 billion in the January to March period, or 1,255 percent more than the P164.16 million in the same three months last year.

"CEB attributes its bullish income and passenger growth to increased presence in key markets, strategic seat sales offering the lowest possible fares and continuous network expansion," JR Mantaring, officer-in-charge for CEB corporate affairs.

Revenue rose by a fifth to P14.2 billion this year from P11.764 billion last year.

The passenger business, which comprised nearly three-fourths of CEB’s revenue, climbed by 22 percent to P10.81 billion from P8.85 billion in 2014.

The Gokongwei-owned airline ascribed this to the 13 percent increase in passenger volume to 4.3 million from 3.8 million last year and the 8.1 percent increase in average fares to P2,525 from last year’s P2,336.

CEB mounted 14.3 percent more flights after it acquired wide-body Airbus A330 aircraft with a configuration of more than 400 all-economy class seats.

Cargo revenues increased 13.6 percent to P772.545 million from P679.818 million last year.

Operating expenses rose by a slower one percent to P11.368 billion this year from P11.252 billion last year. While the company embarked on costlier long-haul flights, cheaper jet fuel tempered overall expenses by 17 percent to P5.144 billion this year from P6.2 billion in 2014.

Aviation fuel expenses fell by 22.1 percent to P4.325 billion from P5.551 billion over the same period.

Published jet fuel prices averaged $68.98 per barrel, half the $121.47 in 2014.

- Interaksyon

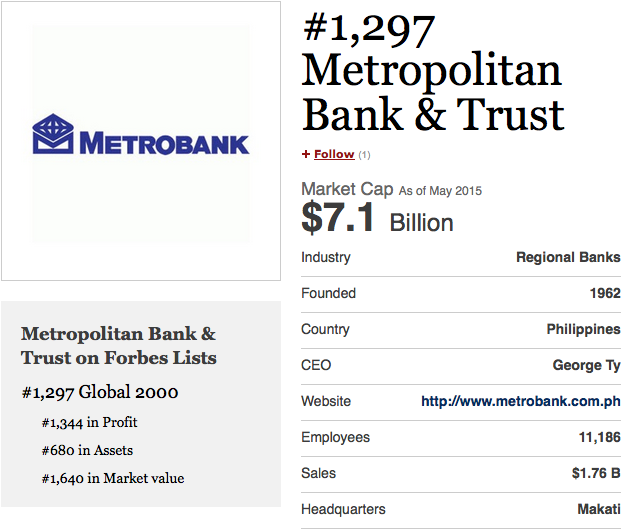

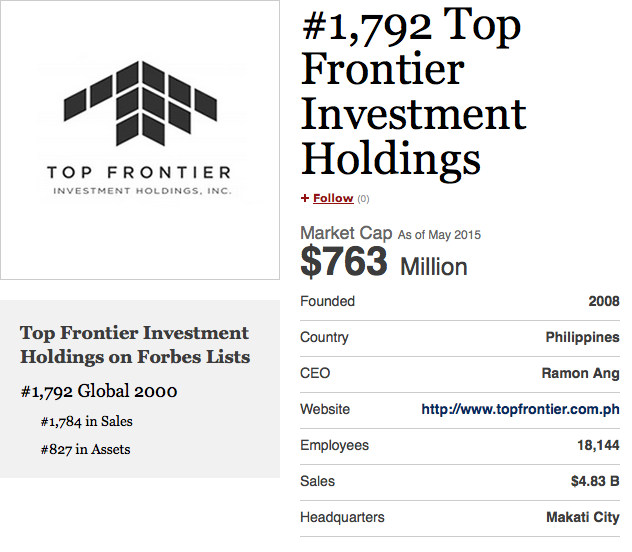

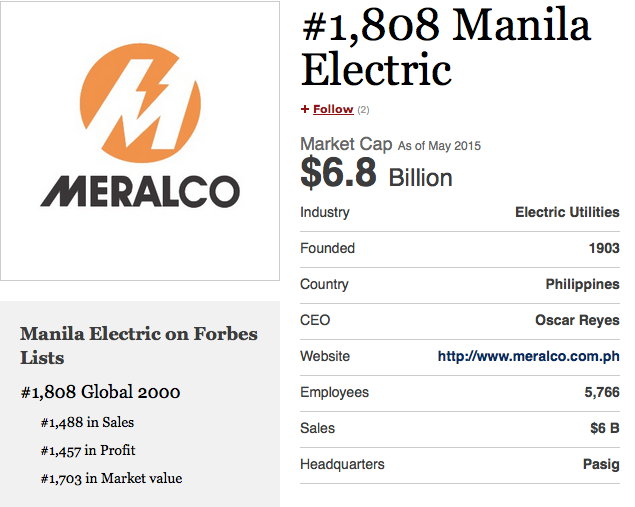

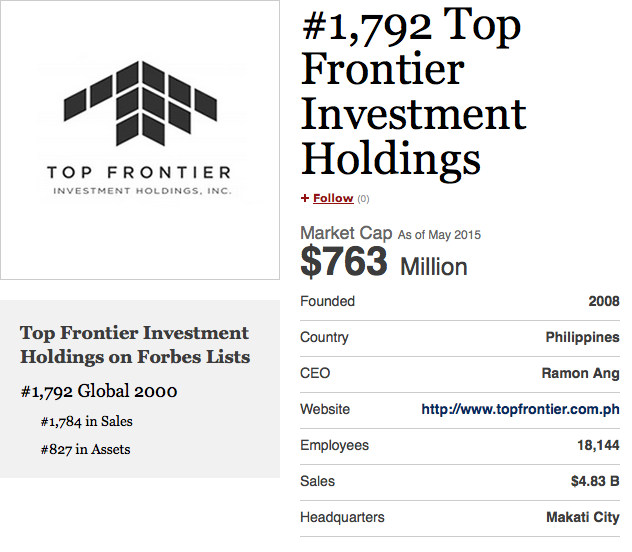

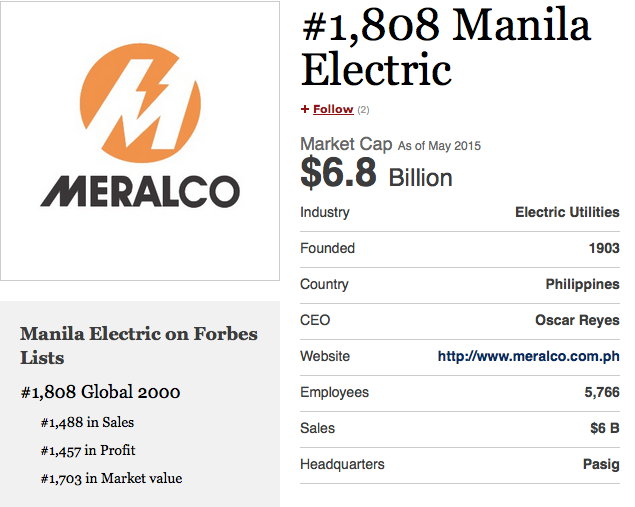

8 Philippine companies make it to Forbes' list of top global firms

The listed holding company of the country's richest man is the top-ranking Philippine firm in Forbes' list of the world's biggest public corporations.

SM Investments Corporation, which earns its keep from banking, property and retail, landed in the top 1,000 at 911th place among the world's top 2,000 publicly-listed firms. Joining SM were two Ayala-owned firms (BPI and Ayala Corporation), two companies chaired by businessman Manuel V. Pangilinan (PLDT and Meralco), George Ty-owned Metrobank, John Gokongwei's JG Summit and Top Frontier Investment Holdings Inc, which is owned by San Miguel Corporation.

Here are the screen grabs of Forbes' profiles on the eight companies:

- Interaksyon

SM Investments Corporation, which earns its keep from banking, property and retail, landed in the top 1,000 at 911th place among the world's top 2,000 publicly-listed firms. Joining SM were two Ayala-owned firms (BPI and Ayala Corporation), two companies chaired by businessman Manuel V. Pangilinan (PLDT and Meralco), George Ty-owned Metrobank, John Gokongwei's JG Summit and Top Frontier Investment Holdings Inc, which is owned by San Miguel Corporation.

Here are the screen grabs of Forbes' profiles on the eight companies:

- Interaksyon

Wednesday, May 6, 2015

Philippines' largest telco sees costly, painful fight

Philippine Long Distance Telephone, the country's largest telecommunications firm, said Tuesday it expects to spend nearly $1 billion in a "painful" fight to survive the consumer shift to digital from traditional phone services.

The listed company said net profit for the first three months of the year was flat at 9.4 billion pesos ($211 million), and the full-year net profit would likely fall below the 34.1 billion pesos it posted last year.

The company said the growth in its mobile Internet business had not been strong enough to offset the decline in its traditional revenue sources -- voice calls and text messaging -- that account for 60 percent of the total.

"It's either we pivot or we perish," PLDT chairman Manuel Pangilinan told reporters.

He said PLDT may exceed the record 39-billion peso ($876 million) expansion budget it set this year to build more 3G and LTE (Long-Term Evolution) infrastructure and entice more of its subscribers to go online.

"In many respects, it's like changing tyres while the car is moving," he said.

"The whole way into this is to implement the digital pivot... It will be painful."

While data and broadband revenue grew 11 percent to 11.2 billion pesos in the January-March period, it accounted for only 27 percent of the total.

Revenue from local voice calls and text messages dipped two percent to 24.2 billion pesos.

Revenue from international and domestic long distance calls, which account for 13 percent of the total, fell 19 percent to 5.2 billion pesos.

"There is an ongoing evolution of the telco subscriber into the digital consumer and there is a need by PLDT to identify new ways of serving the customer," said company president Napoleon Nazareno.

He said PLDT would continue offering free access to selected websites and applications to whet consumers' appetite and persuade them to subscribe to full data plans.

While Filipinos are among the world's most active Internet users, the country also has one of the slowest average connection speeds.

The record capital outlay this year would help address that, company spokesman Ramon Isberto told AFP.

Pangilinan said he could not say when revenues from PLDT's Internet services would overtake those from its so-called "legacy" businesses.

"Every 10 years there is a revolution in this industry. It will be a contest on various fronts -- infrastructure, pricing, digital experience," he said.

- Yahoo News

The listed company said net profit for the first three months of the year was flat at 9.4 billion pesos ($211 million), and the full-year net profit would likely fall below the 34.1 billion pesos it posted last year.

The company said the growth in its mobile Internet business had not been strong enough to offset the decline in its traditional revenue sources -- voice calls and text messaging -- that account for 60 percent of the total.

"It's either we pivot or we perish," PLDT chairman Manuel Pangilinan told reporters.

He said PLDT may exceed the record 39-billion peso ($876 million) expansion budget it set this year to build more 3G and LTE (Long-Term Evolution) infrastructure and entice more of its subscribers to go online.

"In many respects, it's like changing tyres while the car is moving," he said.

"The whole way into this is to implement the digital pivot... It will be painful."

While data and broadband revenue grew 11 percent to 11.2 billion pesos in the January-March period, it accounted for only 27 percent of the total.

Revenue from local voice calls and text messages dipped two percent to 24.2 billion pesos.

Revenue from international and domestic long distance calls, which account for 13 percent of the total, fell 19 percent to 5.2 billion pesos.

"There is an ongoing evolution of the telco subscriber into the digital consumer and there is a need by PLDT to identify new ways of serving the customer," said company president Napoleon Nazareno.

He said PLDT would continue offering free access to selected websites and applications to whet consumers' appetite and persuade them to subscribe to full data plans.

While Filipinos are among the world's most active Internet users, the country also has one of the slowest average connection speeds.

The record capital outlay this year would help address that, company spokesman Ramon Isberto told AFP.

Pangilinan said he could not say when revenues from PLDT's Internet services would overtake those from its so-called "legacy" businesses.

"Every 10 years there is a revolution in this industry. It will be a contest on various fronts -- infrastructure, pricing, digital experience," he said.

- Yahoo News

Friday, April 24, 2015

How to download COL Financial Android APP

Good news to android phone users! You can now download the COL financial android app by following the simple steps below

Reminder: This is only available to those with COL financial account

Your phone should allow to install apk from outside source. You can check it on your phone settings

Your phone should allow to install apk from outside source. You can check it on your phone settings

Click Downloads

Then Click the "Download COLFINANCIAL for Android3" below

Click ok then it will start downloading the APK file and will install it automatically

Saturday, April 18, 2015

Splash's first-quarter profit up by nearly half

The listed manufacturer of Barrio Fiesta food products and Maxipeel and Skinwhite personal care items grew its net income by nearly half in the first quarter of this year.

In a disclosure to the Philippine Stock Exchange, Splash Corporation said it earned P49 million in the January to March period, a 46 percent increase from the P38 million in the same three months of last year.

This year's first-quarter profit already exceeded the P12 million that Splash earned for the entire 2014. Last year's earnings had fallen from the P73 million in 2013, when the company enjoyed P70 million in non-recurring gain from the sale of a non-core asset.

Without the non-recurring gain, core profit in 2014 was four times the amount earned in 2013.

Sales of P3.5 billion for the entire 2014 were flat from P3.4 billion the previous year. In the first quarter of this year, sales rose 15 percent to P957 million from last year's P832 million.

The 18 percent increase in the personal care segment was responsible for growth in the first quarter, offsetting the 10 percent slide in the food segment, which remains in investment mode.

- Interaksyon

In a disclosure to the Philippine Stock Exchange, Splash Corporation said it earned P49 million in the January to March period, a 46 percent increase from the P38 million in the same three months of last year.

This year's first-quarter profit already exceeded the P12 million that Splash earned for the entire 2014. Last year's earnings had fallen from the P73 million in 2013, when the company enjoyed P70 million in non-recurring gain from the sale of a non-core asset.

Without the non-recurring gain, core profit in 2014 was four times the amount earned in 2013.

Sales of P3.5 billion for the entire 2014 were flat from P3.4 billion the previous year. In the first quarter of this year, sales rose 15 percent to P957 million from last year's P832 million.

The 18 percent increase in the personal care segment was responsible for growth in the first quarter, offsetting the 10 percent slide in the food segment, which remains in investment mode.

- Interaksyon

Wednesday, March 25, 2015

Cebu Pacific's net income gets a lift from increase in passengers

The country’s largest budget airline saw its profit rise by two-thirds last year.

In a disclosure to the Philippine Stock Exchange, Gokongwei-owned Cebu Air Inc (CEB) said it earned P853.5 million in 2014, up 67 percent from the P511.95 million the previous year.

Fueling the growth was a 27 percent increase in revenue to P52 billion last year from P41 billion in 2013. Passenger revenue comprised 77 percent of total revenue and increased by 27 percent to P40.19 billion from P31.66 billion over the same period. Cargo revenue also grew by 20.6 percent and comprised 6 percent of the top line.

The operator of Cebu Pacific ascribed the higher revenue to a 17.5 percent growth in passenger volume to 16.9 million last year from 14.4 million in 2013.

The budget carrier fielded 6.9 percent more flights after it acquired wide-body Airbus A330 to bring its fleet to 52 by yearend.

Alongside the higher number of flights, operating expenses also climbed 23.9 percent to P47.843 billion last year from the P38.6 billion in 2013. More than half of that pertained to flying operational expenses, which also increased by a fifth.

Lower jet fuel prices however partly made up for the increase in fuel expenses brought about by the higher number of flights mounted. Jet fuel cost $112.48 a barrel last year, down from the $122.97 average in 2013.

Jet fuel comprised half of operating expenses and rose 19 percent year-on-year.

Cebu Pacific shares were down 2 percent at P85.25 each at the close of trading today.

- Interaksyon

In a disclosure to the Philippine Stock Exchange, Gokongwei-owned Cebu Air Inc (CEB) said it earned P853.5 million in 2014, up 67 percent from the P511.95 million the previous year.

Fueling the growth was a 27 percent increase in revenue to P52 billion last year from P41 billion in 2013. Passenger revenue comprised 77 percent of total revenue and increased by 27 percent to P40.19 billion from P31.66 billion over the same period. Cargo revenue also grew by 20.6 percent and comprised 6 percent of the top line.

The operator of Cebu Pacific ascribed the higher revenue to a 17.5 percent growth in passenger volume to 16.9 million last year from 14.4 million in 2013.

The budget carrier fielded 6.9 percent more flights after it acquired wide-body Airbus A330 to bring its fleet to 52 by yearend.

Alongside the higher number of flights, operating expenses also climbed 23.9 percent to P47.843 billion last year from the P38.6 billion in 2013. More than half of that pertained to flying operational expenses, which also increased by a fifth.

Lower jet fuel prices however partly made up for the increase in fuel expenses brought about by the higher number of flights mounted. Jet fuel cost $112.48 a barrel last year, down from the $122.97 average in 2013.

Jet fuel comprised half of operating expenses and rose 19 percent year-on-year.

Cebu Pacific shares were down 2 percent at P85.25 each at the close of trading today.

- Interaksyon

Thursday, March 12, 2015

Residential sales boost Filinvest Land's 2014 net income

Filinvest Land Inc’s (FLI) earnings last year grew in the mid-teens on the strength of residential sales.

In a disclosure to the Philippine Stock Exchange, Gotianun-led FLI said it earned P4.60 billion in 2014, a 16 percent increase from the P3.98 billion the prvious year.

Revenue rose by more than a fifth to P16.90 billion, of which P13.20 billion came from residential sales, which increased by 26 percent from the P10.48 billion in 2013.

Sales came from its Futura Homes affordable housing projects, medium-rise buildings that carry the “Oasis” and “Spatial” brands, and its Studio Series high-rise buildings. FLI launched P12.5 billion worth of residential projects last year.

Rental revenue from its office segment increased by 11 percent to P2.26 billion from the previous year’s P2.03 billion, with the growth coming from new buildings such as the “Filinvest One” and “Plaz@ E”, both at the Northgate Cyberzone in Filinvest City Alabang, Muntinlupa.

To date, FLI has 14 office buildings, with three more in the pipeline, completion of which would increase the company’s portfolio to 274,971 square meters.

For this year, the company aims to launch P16 billion worth of projects, on track to hitting its plan of having a recurring income portfolio of 970,000 square meters by 2019.

“We are targeting to increase our gross leasable area to three times our current office and retail space inventory within the next five years. For 2015, we are adding around 67,506 square meters of office space and 85,034 square meters of retail space to our portfolio,” said FLI chief executive Josephine Gotianun-Yap.

“The outstanding performance of FLI in 2014 was brought about by the company’s ability to address the needs of homebuyers as reflected in the consistent growth of residential sales and its ability to execute its plans to increase office as well as retail spaces in key locations nationwide,” she added.

- Interaksyon

In a disclosure to the Philippine Stock Exchange, Gotianun-led FLI said it earned P4.60 billion in 2014, a 16 percent increase from the P3.98 billion the prvious year.

Revenue rose by more than a fifth to P16.90 billion, of which P13.20 billion came from residential sales, which increased by 26 percent from the P10.48 billion in 2013.

Sales came from its Futura Homes affordable housing projects, medium-rise buildings that carry the “Oasis” and “Spatial” brands, and its Studio Series high-rise buildings. FLI launched P12.5 billion worth of residential projects last year.

Rental revenue from its office segment increased by 11 percent to P2.26 billion from the previous year’s P2.03 billion, with the growth coming from new buildings such as the “Filinvest One” and “Plaz@ E”, both at the Northgate Cyberzone in Filinvest City Alabang, Muntinlupa.

To date, FLI has 14 office buildings, with three more in the pipeline, completion of which would increase the company’s portfolio to 274,971 square meters.

For this year, the company aims to launch P16 billion worth of projects, on track to hitting its plan of having a recurring income portfolio of 970,000 square meters by 2019.

“We are targeting to increase our gross leasable area to three times our current office and retail space inventory within the next five years. For 2015, we are adding around 67,506 square meters of office space and 85,034 square meters of retail space to our portfolio,” said FLI chief executive Josephine Gotianun-Yap.

“The outstanding performance of FLI in 2014 was brought about by the company’s ability to address the needs of homebuyers as reflected in the consistent growth of residential sales and its ability to execute its plans to increase office as well as retail spaces in key locations nationwide,” she added.

- Interaksyon

Sunday, March 8, 2015

Smart bundles prepaid offers with free internet

Smart Communications Inc. is rewarding its prepaid subscribers who avail of call and text offers with free internet to boost the use of mobile data.

Up to 30MB of free data per day will be allotted for prepaid subscribers as part of call and text bundles.

“With the successful run of our Smart Free Internet offer, many of our subscribers were able to experience real-life benefits of staying connected to mobile Internet – from getting in touch with their loved ones, accessing news and information, to enjoying the wealth of entertaining content available online,” said Smart executive vice president and head of the wireless consumer business Charles Lim.

Lim said the new offer comes following the success of the telecommunication firm’s Free Internet promo introduced in September.

The free promo has been extended four times, with the latest cut-off date set on March 15. Smart offers a call, text and surf promo for its prepaid customers under All Text 20 Plus, which provides 45MB of surfing, along with unlimited text to all networks, 20 minutes of calls to Smart, Sun and TNT, all valid for one day.

The network has also enhanced its Unli Call and Text 25 promos with 45MB of surfing, along with unlimited calls to Smart and TNT, unlimited text to Smart, Sun and TNT, and 50 texts to other networks, all valid for one day.

Unli Call and Text 50, on the other hand, now comes with 140MB of surfing along with unlimited calls to Smart, TNT and Sun, unlimited text to all networks, valid for three days.

Other promos will also get additional 30MB.

“This new offer will enable us to further pursue our Internet for All campaign and encourage more people to stay connected, empowered, and enriched by Smart’s fast, fun and worry-free mobile Internet, which is at the core of our Internet for All campaign this year,” Lim said.

Mobile data revenues of the Philippine Long Distance Telephone Company reached P8.1 billion in 2014, P3.1 billion higher than the P5 billion posted in 2013.

- ABS-CBN News

Up to 30MB of free data per day will be allotted for prepaid subscribers as part of call and text bundles.

“With the successful run of our Smart Free Internet offer, many of our subscribers were able to experience real-life benefits of staying connected to mobile Internet – from getting in touch with their loved ones, accessing news and information, to enjoying the wealth of entertaining content available online,” said Smart executive vice president and head of the wireless consumer business Charles Lim.

Lim said the new offer comes following the success of the telecommunication firm’s Free Internet promo introduced in September.

The free promo has been extended four times, with the latest cut-off date set on March 15. Smart offers a call, text and surf promo for its prepaid customers under All Text 20 Plus, which provides 45MB of surfing, along with unlimited text to all networks, 20 minutes of calls to Smart, Sun and TNT, all valid for one day.

The network has also enhanced its Unli Call and Text 25 promos with 45MB of surfing, along with unlimited calls to Smart and TNT, unlimited text to Smart, Sun and TNT, and 50 texts to other networks, all valid for one day.

Unli Call and Text 50, on the other hand, now comes with 140MB of surfing along with unlimited calls to Smart, TNT and Sun, unlimited text to all networks, valid for three days.

Other promos will also get additional 30MB.

“This new offer will enable us to further pursue our Internet for All campaign and encourage more people to stay connected, empowered, and enriched by Smart’s fast, fun and worry-free mobile Internet, which is at the core of our Internet for All campaign this year,” Lim said.

Mobile data revenues of the Philippine Long Distance Telephone Company reached P8.1 billion in 2014, P3.1 billion higher than the P5 billion posted in 2013.

- ABS-CBN News

Friday, March 6, 2015

Emperador eyes growth of more than a third after 2014 profit climbs on acquisitions

The country’s biggest liquor company grew its earnings in the low single digit last year.

In a disclosure to the Philippine Stock Exchange, Emperador Inc said its profit rose 5 percent to P6.1 billion last year from P5.8 billion in 2013.

This as revenues climbed 7 percent to P32 billion from P29.8 billion over the same period after the company spent P35 billion last year on acquisitions around the world.

“We have successfully transformed Emperador into a global company after our acquisition of Whyte and Mackay in the United Kingdom and various vineyard and brandy production facilities in Spain,” Emperador chairman Andrew Tan said.

“We see 2015 as the beginning of the rapid expansion of our businesses, both in the domestic and global markets. This year, we expect our revenues to grow by 35 percent,” he added.

Citing Euromonitor International, Emperador said the global brandy market could grow from 2013 to 2018, with volume reaching 195 million cases by the end of that period.

“Out of 100 bottles of brandy sold in the world today, 21 bottles are Emperador. We are set to launch Emperador in several countries in Europe and Africa, and we will be very active in Duty Free travel retail shops globally," said Emperador International managing director Jorge Domecq.

"Depending on the price points required by our clients, we can supply Emperador products from either the Philippines or Spain. With our aggressive pace, we expect our current share in the world brandy market to grow even further," he said.

Emperador chief finance officer Dina Inting said the company closed 2014 with a net cash position of P4.85 billion.

“In spite of spending close to P35 billion overseas last year, we will be debt-free in a few months because we intend to pre-pay our loan using the huge cash pile that is now sitting in our balance sheet. This gives us a lot of room for more acquisitions and expansion activities when opportunities arise in the domestic and global markets," she said.

Emperador president Winston Co said the company will launch 8 major products in the Philippines this year.

“This 2015 will be the busiest and most exciting year for the company," he said.

- Interaksyon

In a disclosure to the Philippine Stock Exchange, Emperador Inc said its profit rose 5 percent to P6.1 billion last year from P5.8 billion in 2013.

This as revenues climbed 7 percent to P32 billion from P29.8 billion over the same period after the company spent P35 billion last year on acquisitions around the world.

“We have successfully transformed Emperador into a global company after our acquisition of Whyte and Mackay in the United Kingdom and various vineyard and brandy production facilities in Spain,” Emperador chairman Andrew Tan said.

“We see 2015 as the beginning of the rapid expansion of our businesses, both in the domestic and global markets. This year, we expect our revenues to grow by 35 percent,” he added.

Citing Euromonitor International, Emperador said the global brandy market could grow from 2013 to 2018, with volume reaching 195 million cases by the end of that period.

“Out of 100 bottles of brandy sold in the world today, 21 bottles are Emperador. We are set to launch Emperador in several countries in Europe and Africa, and we will be very active in Duty Free travel retail shops globally," said Emperador International managing director Jorge Domecq.

"Depending on the price points required by our clients, we can supply Emperador products from either the Philippines or Spain. With our aggressive pace, we expect our current share in the world brandy market to grow even further," he said.

Emperador chief finance officer Dina Inting said the company closed 2014 with a net cash position of P4.85 billion.

“In spite of spending close to P35 billion overseas last year, we will be debt-free in a few months because we intend to pre-pay our loan using the huge cash pile that is now sitting in our balance sheet. This gives us a lot of room for more acquisitions and expansion activities when opportunities arise in the domestic and global markets," she said.

Emperador president Winston Co said the company will launch 8 major products in the Philippines this year.

“This 2015 will be the busiest and most exciting year for the company," he said.

- Interaksyon

Sunday, March 1, 2015

Meralco buys into company that runs Pampanga electric coop

Meralco has taken over the company that won the contract to manage an electric cooperative in Pampanga province.

In a disclosure to the Philippine Stock Exchange, Manila Electric Company said it signed yesterday a shareholders agreement with Comstech Integration Alliance Inc.

Under the deal, Meralco will subscribe to 300 million shares that Comstech will issue at P100 a share. The deal cost Meralco P300 million and gives it a 60 percent stake in Comstech.

Prior to its investment, Meralco served as technical advisor to Comstech, which last year bagged the investment management contract for the operation and management of the Pampanga II Electric Cooperative (PELCO II).

PELCO II distributes electricity in one city and six towns of Pampanga.

- Interaksyon

Thursday, February 26, 2015

Higher revenue across units lifts Metro Pacific's 2014 profit

The Metro Pacific Group saw earnings rise by a tenth last year despite delays in regulatory approval of its units’ pending rate adjustments.

In a disclosure to the Philippine Stock Exchange, Metro Pacific Investments Corporation (MPIC) said its net income climbed 10 percent to P7.9 billion last year from P7.2 billion in 2013.

This as revenue rose by 10 percent to P33.8 billion from P30.9 billion over the same period.

"All our operating companies reported strong profitability for the year. This reflects our intense focus on operational efficiencies but at the cost of the years of high capital expenditures," Jose Ma. K. Lim, MPIC president and chief executive said.

Maynilad Water Services Inc contributed the biggest to MPIC’s profitability at P4.4 billion, followed by Manila Electric Company’s P3 billion. Metro Pacific Tollways Corporation delivered P2.2 billion, while the Hospital Group contributed P465 million.

"We anticipate continued strong volume growth in 2015 for all our subsidiaries in light of anticipated continuing economic growth," Lim said.