The Philippine unit of Malaysian budget carrier AirAsia Berhad is seeking a valuation of at least $500 million for its initial public offering (IPO) set within the next two years, one of its top executives said.

Michael Romero, vice chair of Philippines-based AirAsia Inc., said in a recent interview that plans to go public were still on track. This follows recent statements by Malaysian tycoon Tony Fernandes, founder of AirAsia Berhad, relating to a plan to hold an IPO for its Philippine and Indonesian units.

“We are looking at a [float] of 30 percent to 40 percent,” Romero said, meaning the carrier can raise as much as $200 million from its IPO. He declined to elaborate, as plans have yet to be finalized.

The decision comes as domestic financial operations, which include AirAsia Philippines and AirAsia Zest, are improving, consultancy firm Capa-Center of Aviation said in a report this month.

“The AirAsia Group’s Philippine affiliates likely remained in the red in [first quarter 2015] but are expected to be profitable in the second quarter of 2015,” Capa said. “This would mark the first profitable quarter for AirAsia in the Philippines.”

Capa noted that the second quarter is typically the strongest period for local carriers as this is marked by the travel-heavy summer holidays.

AirAsia, which had 15 Airbus A320s in the Philippines at the end of 2014, controls about 10 percent of the Philippine market. It mainly competes Philippine Airlines and budget airline Cebu Pacific in the domestic market.

AirAsia Philippines still receives financial support from its parent company. AirAsia Bhd said in a filing to the Malaysian Stock Exchange last Feb. 26, 2015 that it provided another $22.34 million loan to AirAsia Inc., as the Philippine unit is formally known, “to facilitate the ordinary course of business of AirAsia Inc.”

In an interview last November, Fernandes said AirAsia Bhd was committing at least $500 million for the expansion of its Philippine operations once its units were consolidated. He was referring to the consolidation of both AirAsia Philippines and AirAsia Zest, which is still ongoing.

- Inquirer

Philippines News: FREE

Friday, May 22, 2015

Saturday, May 16, 2015

Cebu Pacific's net income soars amid slump in price of jet fuel

Cebu Pacific is making a killing, as first-quarter profit soared because of the combination of lower fuel costs and strong demand for travel.

In a statement, Cebu Air Inc (CEB) said it earned P2.23 billion in the January to March period, or 1,255 percent more than the P164.16 million in the same three months last year.

"CEB attributes its bullish income and passenger growth to increased presence in key markets, strategic seat sales offering the lowest possible fares and continuous network expansion," JR Mantaring, officer-in-charge for CEB corporate affairs.

Revenue rose by a fifth to P14.2 billion this year from P11.764 billion last year.

The passenger business, which comprised nearly three-fourths of CEB’s revenue, climbed by 22 percent to P10.81 billion from P8.85 billion in 2014.

The Gokongwei-owned airline ascribed this to the 13 percent increase in passenger volume to 4.3 million from 3.8 million last year and the 8.1 percent increase in average fares to P2,525 from last year’s P2,336.

CEB mounted 14.3 percent more flights after it acquired wide-body Airbus A330 aircraft with a configuration of more than 400 all-economy class seats.

Cargo revenues increased 13.6 percent to P772.545 million from P679.818 million last year.

Operating expenses rose by a slower one percent to P11.368 billion this year from P11.252 billion last year. While the company embarked on costlier long-haul flights, cheaper jet fuel tempered overall expenses by 17 percent to P5.144 billion this year from P6.2 billion in 2014.

Aviation fuel expenses fell by 22.1 percent to P4.325 billion from P5.551 billion over the same period.

Published jet fuel prices averaged $68.98 per barrel, half the $121.47 in 2014.

- Interaksyon

In a statement, Cebu Air Inc (CEB) said it earned P2.23 billion in the January to March period, or 1,255 percent more than the P164.16 million in the same three months last year.

"CEB attributes its bullish income and passenger growth to increased presence in key markets, strategic seat sales offering the lowest possible fares and continuous network expansion," JR Mantaring, officer-in-charge for CEB corporate affairs.

Revenue rose by a fifth to P14.2 billion this year from P11.764 billion last year.

The passenger business, which comprised nearly three-fourths of CEB’s revenue, climbed by 22 percent to P10.81 billion from P8.85 billion in 2014.

The Gokongwei-owned airline ascribed this to the 13 percent increase in passenger volume to 4.3 million from 3.8 million last year and the 8.1 percent increase in average fares to P2,525 from last year’s P2,336.

CEB mounted 14.3 percent more flights after it acquired wide-body Airbus A330 aircraft with a configuration of more than 400 all-economy class seats.

Cargo revenues increased 13.6 percent to P772.545 million from P679.818 million last year.

Operating expenses rose by a slower one percent to P11.368 billion this year from P11.252 billion last year. While the company embarked on costlier long-haul flights, cheaper jet fuel tempered overall expenses by 17 percent to P5.144 billion this year from P6.2 billion in 2014.

Aviation fuel expenses fell by 22.1 percent to P4.325 billion from P5.551 billion over the same period.

Published jet fuel prices averaged $68.98 per barrel, half the $121.47 in 2014.

- Interaksyon

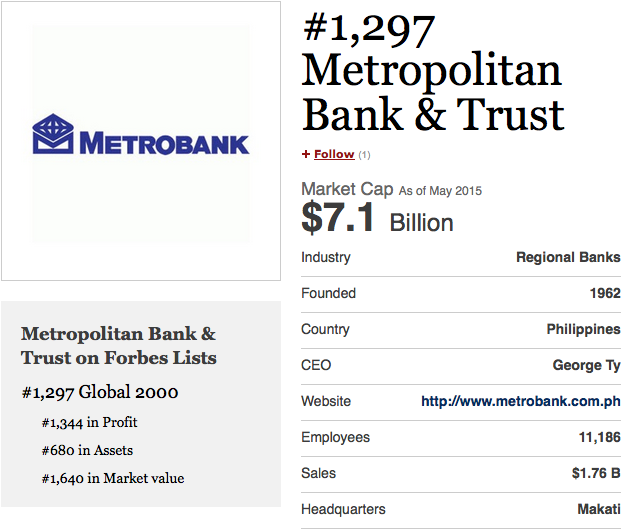

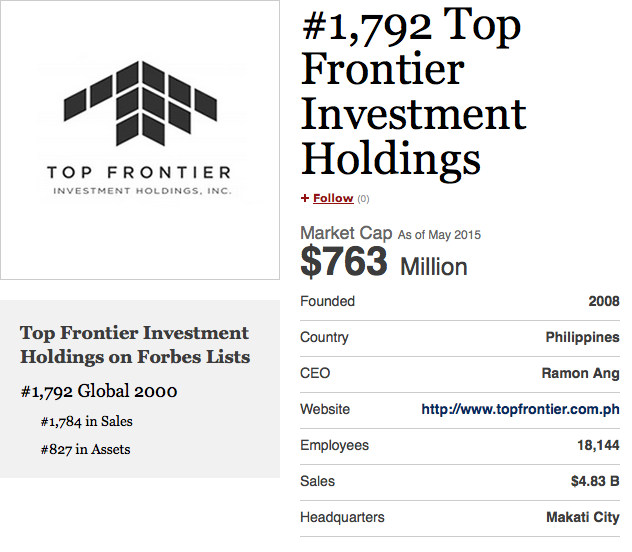

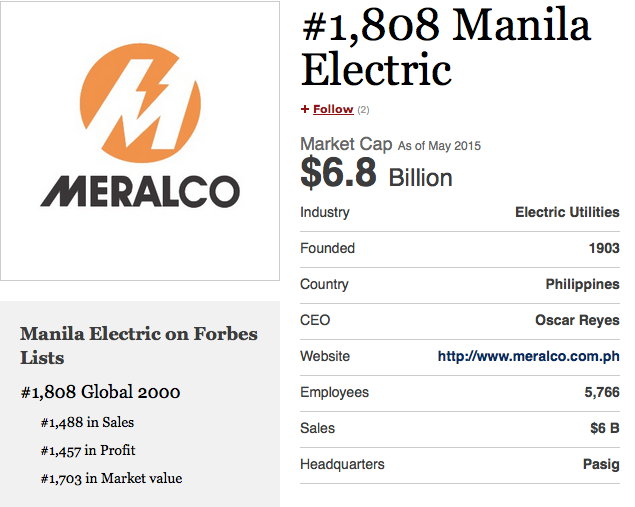

8 Philippine companies make it to Forbes' list of top global firms

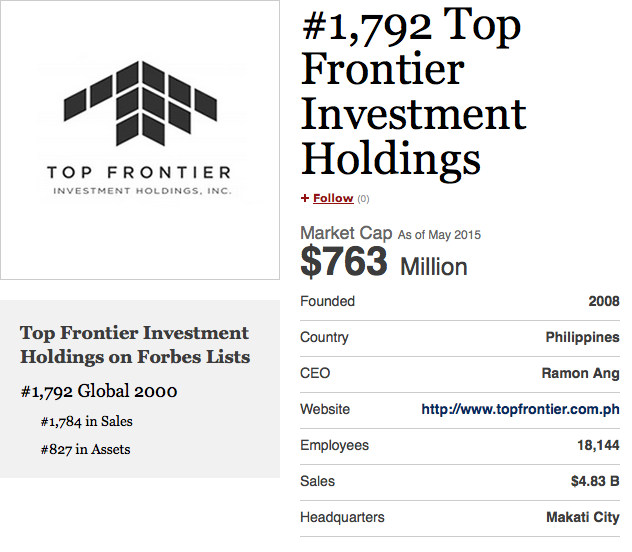

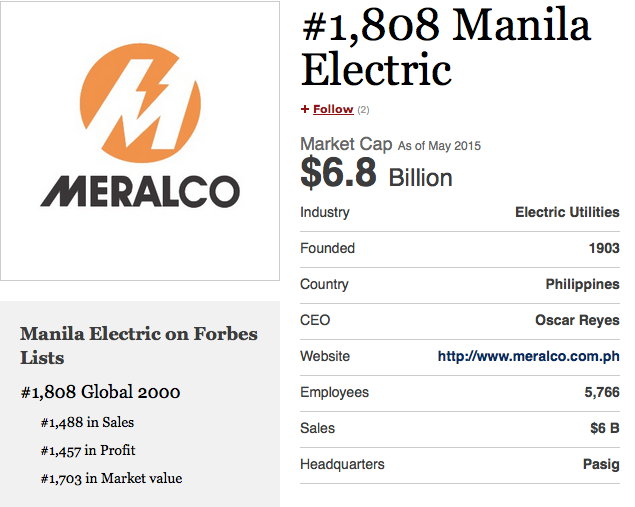

The listed holding company of the country's richest man is the top-ranking Philippine firm in Forbes' list of the world's biggest public corporations.

SM Investments Corporation, which earns its keep from banking, property and retail, landed in the top 1,000 at 911th place among the world's top 2,000 publicly-listed firms. Joining SM were two Ayala-owned firms (BPI and Ayala Corporation), two companies chaired by businessman Manuel V. Pangilinan (PLDT and Meralco), George Ty-owned Metrobank, John Gokongwei's JG Summit and Top Frontier Investment Holdings Inc, which is owned by San Miguel Corporation.

Here are the screen grabs of Forbes' profiles on the eight companies:

- Interaksyon

SM Investments Corporation, which earns its keep from banking, property and retail, landed in the top 1,000 at 911th place among the world's top 2,000 publicly-listed firms. Joining SM were two Ayala-owned firms (BPI and Ayala Corporation), two companies chaired by businessman Manuel V. Pangilinan (PLDT and Meralco), George Ty-owned Metrobank, John Gokongwei's JG Summit and Top Frontier Investment Holdings Inc, which is owned by San Miguel Corporation.

Here are the screen grabs of Forbes' profiles on the eight companies:

- Interaksyon

Wednesday, May 6, 2015

Philippines' largest telco sees costly, painful fight

Philippine Long Distance Telephone, the country's largest telecommunications firm, said Tuesday it expects to spend nearly $1 billion in a "painful" fight to survive the consumer shift to digital from traditional phone services.

The listed company said net profit for the first three months of the year was flat at 9.4 billion pesos ($211 million), and the full-year net profit would likely fall below the 34.1 billion pesos it posted last year.

The company said the growth in its mobile Internet business had not been strong enough to offset the decline in its traditional revenue sources -- voice calls and text messaging -- that account for 60 percent of the total.

"It's either we pivot or we perish," PLDT chairman Manuel Pangilinan told reporters.

He said PLDT may exceed the record 39-billion peso ($876 million) expansion budget it set this year to build more 3G and LTE (Long-Term Evolution) infrastructure and entice more of its subscribers to go online.

"In many respects, it's like changing tyres while the car is moving," he said.

"The whole way into this is to implement the digital pivot... It will be painful."

While data and broadband revenue grew 11 percent to 11.2 billion pesos in the January-March period, it accounted for only 27 percent of the total.

Revenue from local voice calls and text messages dipped two percent to 24.2 billion pesos.

Revenue from international and domestic long distance calls, which account for 13 percent of the total, fell 19 percent to 5.2 billion pesos.

"There is an ongoing evolution of the telco subscriber into the digital consumer and there is a need by PLDT to identify new ways of serving the customer," said company president Napoleon Nazareno.

He said PLDT would continue offering free access to selected websites and applications to whet consumers' appetite and persuade them to subscribe to full data plans.

While Filipinos are among the world's most active Internet users, the country also has one of the slowest average connection speeds.

The record capital outlay this year would help address that, company spokesman Ramon Isberto told AFP.

Pangilinan said he could not say when revenues from PLDT's Internet services would overtake those from its so-called "legacy" businesses.

"Every 10 years there is a revolution in this industry. It will be a contest on various fronts -- infrastructure, pricing, digital experience," he said.

- Yahoo News

The listed company said net profit for the first three months of the year was flat at 9.4 billion pesos ($211 million), and the full-year net profit would likely fall below the 34.1 billion pesos it posted last year.

The company said the growth in its mobile Internet business had not been strong enough to offset the decline in its traditional revenue sources -- voice calls and text messaging -- that account for 60 percent of the total.

"It's either we pivot or we perish," PLDT chairman Manuel Pangilinan told reporters.

He said PLDT may exceed the record 39-billion peso ($876 million) expansion budget it set this year to build more 3G and LTE (Long-Term Evolution) infrastructure and entice more of its subscribers to go online.

"In many respects, it's like changing tyres while the car is moving," he said.

"The whole way into this is to implement the digital pivot... It will be painful."

While data and broadband revenue grew 11 percent to 11.2 billion pesos in the January-March period, it accounted for only 27 percent of the total.

Revenue from local voice calls and text messages dipped two percent to 24.2 billion pesos.

Revenue from international and domestic long distance calls, which account for 13 percent of the total, fell 19 percent to 5.2 billion pesos.

"There is an ongoing evolution of the telco subscriber into the digital consumer and there is a need by PLDT to identify new ways of serving the customer," said company president Napoleon Nazareno.

He said PLDT would continue offering free access to selected websites and applications to whet consumers' appetite and persuade them to subscribe to full data plans.

While Filipinos are among the world's most active Internet users, the country also has one of the slowest average connection speeds.

The record capital outlay this year would help address that, company spokesman Ramon Isberto told AFP.

Pangilinan said he could not say when revenues from PLDT's Internet services would overtake those from its so-called "legacy" businesses.

"Every 10 years there is a revolution in this industry. It will be a contest on various fronts -- infrastructure, pricing, digital experience," he said.

- Yahoo News

Subscribe to:

Posts (Atom)

Labels

#SMPH

#SMPH #ALI #FLI #MEG

8990 Holdings

aboitiz group

Aboitiz Power

AC

AGI

ALI

Alliance global group inc

AP

AYALA

Ayala Corp

Ayala Land Inc

Banks

Belle Corp

Bloomberg

BPI

BSP

CEB

Cebu Pacific

Century Pacific Food Inc

Century Properties Group

CNPF

Col Financial

COL Model Portfolio

COLing the shots

COSCO

CPG

Credit Suisse

D&L

DD

DMCI

DNL

Double Dragon

EDC

EMP

ETF

FED

Filinvest Land Inc

First Philippine Holdings Corp

FLI

FMETF

FMIC

FPH

geri

GLO

Globe

GT Capital Holdings

GTCAP

House

ICT

ICTSI

IMI

IPO

JFC

JGS

Jollibee

LRW

LRWC

LTG

MARC

MBT

MEG

Megaworld Corporation

MER

Meralco

Metobank

Metro Pacific Investment Corp

mpi

MPIC

MWC

Pancake House

PCKH

PGOLD

Philippine Long Distance Telephone Co

Philippine Seven Corporation

Philippine Stock Exchange

Phoenix Petroleum

PLDT

PNB

PNX

PSB

PSE

PSEi

PSPC

purefoods

Puregold Price Club Inc

RFM

San Miguel Corporation

SEVN

SM

SMB

SMC

smph

Stock Market

Stocks

TEL

Universal Robina Corporation

URC